The topic of pure greed and how it can cause people to rationalise their means and ends without considering the consequences of their actions is told in Netflix’s “Pain Hustlers.” The narrative centres on Zanna Therapeutics, a business whose owner and senior officials make every effort to promote the sale of the medication Lonafen. Initially, they trick themselves into thinking that this is what they’re doing to help the real recipients. However, their greed for money quickly consumes them, and in the end, they lose everything. This article examines the actual business and medication that served as the model for the fictional Zanna and Lonafen in the Emily Blunt film. AHEAD OF SPOILERS

The True Inspiration Behind Zanna Therapeutics and Lonafen

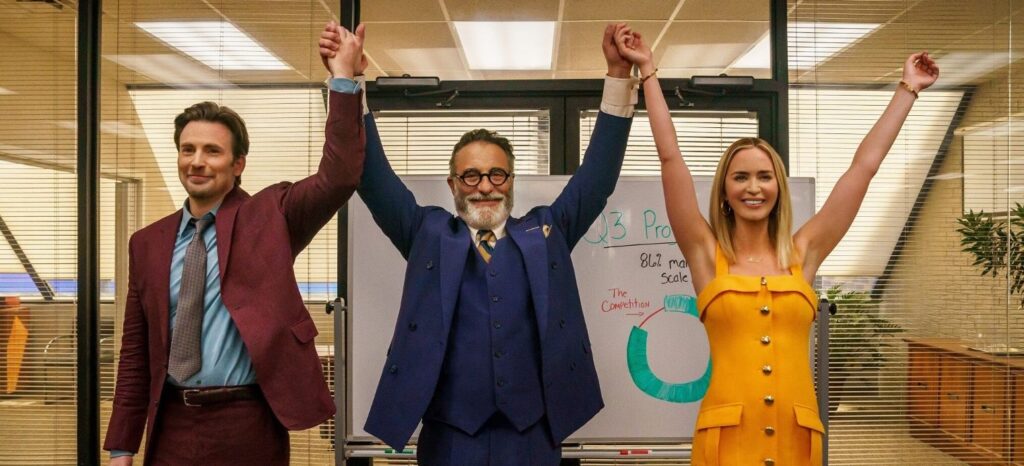

“Pain Hustlers” is somewhat inspired by the occasions surrounding the ascent and collapse of Insys Therapeutics, a pharmaceutical business. It is represented by Zanna, and Lonafen is a stand-in for Insys’s fentanyl-containing medication, Subsys. Andy Garcia’s Jack Neel is modelled by John Kapoor, who founded Insys and battled valiantly to introduce Subsys to the market.

When the film begins, Lonafen has been in business for some time but isn’t making enough money to sustain itself. Neel and his executive group don’t know how to increase revenue to keep their ship from going down. In real life as well, Subsys didn’t function as effectively as Kapoor had anticipated after it was introduced to the market. However, he was committed to the notion of making it work, even if it required breaking the law.

Similar to Lonafen, Subsys is a spray that is supposed to act faster than its competitors on the market. Its intended use is to address “pain associated with breakthrough cancer that is not managed by other medications.” The medication was approved in 2012 following the commencement of clinical studies in 2007. Subsys is an expensive medication because of its particular function; a 100mcg unit costs approximately $70-$80, making it a profitable asset for the corporation.

It is said that Insys has employed every tactic in the book to boost the medication’s sales. Like the majority of other pharmaceutical businesses, Insys hired youthful, attractive individuals as sales representatives and targeted particular doctors. However, it went too far when it introduced its “speakers programme,” which essentially served as a means of paying medical professionals to prescribe Subsys to their patients. Its sale was initially restricted to cancer patients, but later on, they allegedly lobbied for selling it to those who weren’t in that category and had mild to chronic pain as a result of other problems. To illustrate the effect that the company’s leaders’ series of choices had on the lives of regular people, the movie takes all these information and fictionalises them.

How Things Ended For Insys Therapeutics

Though the proprietor and his staff saw a complete transformation with the acquisition of Subsys, the company’s increasingly dubious business practises meant that things would eventually come to an end. Thanks to a number of whistleblowers, the prosecution was able to establish a case against John Kapoor, who received a sentence of 66 months in jail instead of the government’s suggested 15 years. In addition, he received a “order to pay forfeiture and restitution.”

Having “orchestrated a scheme to bribe practitioners to prescribe Subsys,” he was found guilty. Seven other executives and staff members of Insys were convicted of participating in medication sales racketeering activities, which involved paying doctors bribes. Alec Burlakoff, the former vice president of sales, was sentenced to twenty-six months in prison in 2020, while Michael Babich, the former CEO, received a thirty-month sentence.

2019 saw Insys Therapeutics declare for bankruptcy under Chapter 11. Following its agreement to pay $225 million “to settle the government’s separate criminal and civil investigations,” the corporation did this. Subsys was sold to BTcP Pharma LLC of Wyoming, which received royalties for Insys totaling over $20 million. State solicitors general objected to this plan, citing concerns that it might encourage drug misuse. BTcP promised to offer Subsys only to cancer patients, as planned, but there were apparently arguments made that the new business had “ample red flags” to inflate debt.

The objection statement reads as follows: “The court should ensure, in approving any sale, that Subsys will not fall into the hands of those who would further exploit that addiction through intentional conduct or negligence. Patients became addicted to Subsys through Insys’ misconduct, and their addiction has not been treated.” This bankruptcy shouldn’t cause any more harm. The medicine is still being sold, but maybe the distributors are doing a better job of reducing the issues that the prior owners of the drug caused.